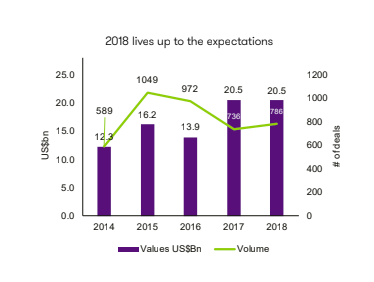

NEW DELHI: The year 2018 saw private equity and venture capital investments worth $20.5 billion in India, the same as in 2017, across 786 transactions.

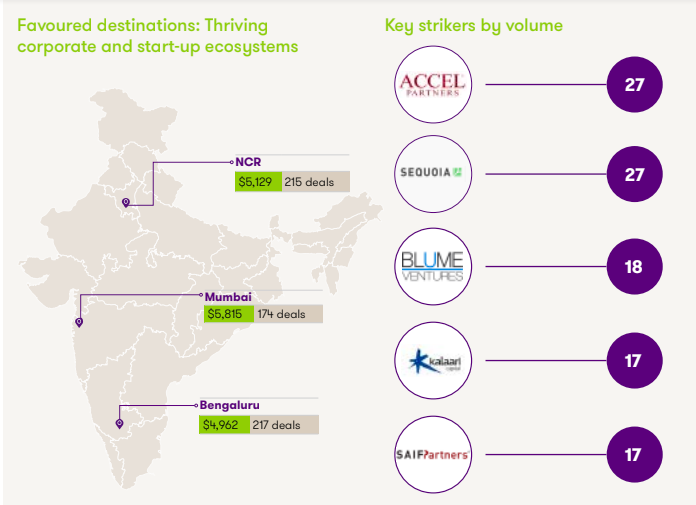

According to the seventh edition of Grant Thornton’s The Fourth Wheel 2019 report, the volumes were driven by tech-enabled start-ups, e-commerce and information technology (IT)/IT enabled service (ITeS).

PE deal volumes are expected to pick up in the second half of the year with 2020 after the volatility in markets subsides after elections expected in May this year. The year 2020 is also expected to be the year of the highest volumes of PE investments provided a stable government forms in India.

The report focuses on PE/VC industry in India and has been produced in association with Indian Private Equity and Venture Capital Association (IVCA), an organisation that works towards promotion of PE/VC firms.

Commenting on the report, Vrinda Mathur, Partner, Grant Thornton India LLP, said, “Matching up to the investment recorded in 2017 signifies a trend rather than a one-time phenomenon in the Indian PE/VC history. The top trending themes during the year were revival of start-ups, continued uptick in control deals and larger bets, and increased focus of sovereign wealth funds towards Indian assets. Startups accounted for 59% of the total PE investments recorded in 2018 by values and 26% by volume.”

In terms of the size of PE/VC investments, the sharp increase in the investment values in 2018 was on account of 47 investments of value $100 million or greater, including six $500 million plus deals. Big-ticket investments were driven by complex deal structures, PE-backed M&A, later-stage funding and the inflated start-up valuations.

According to Padmanabha Sinha, Chairman, IVCA, “Despite a tepid start, the soaring investor confidence in India was evident in the record level of investments, exits and fund raises. A number of global investors also placed their bets on indigenous start-ups and pumped capital into the Indian consumption ecosystem. Several notifications in recent years such as removal of initial public offering (IPO) lock up for AIF investors, banks being allowed to invest in AIF 1 and 2 domestically, and clarification on the characterisation of tax for AIF, among others, have reinstated confidence in the Fourth Wheel.”

While it is not unusual to witness high levels of public spending in election years and it may push investments in rural and infrastructure-related sectors in the near term, core sectors may not get impacted as most mid-market investments take a long term bet on growth potential, the report suggested.