Was it a man or a woman, or an AI software, who wrote the first paper that actually was a turning point and led to the birth of the Bitcoin. Satoshi Nakamoto is the name of the author, and perhaps people will never know who the person was, who led to the creation of the first bitcoins. Nakamoto has over 1 million bitcoins worth over $17.2 billion, as of today. Nakamoto has however never touched or encashed any of the bitcoin, which lies unused in his/her/it’s wallet, till date.

Below is the research paper that Satoshi Nakamoto wrote that led to the creation and mining of the first bitcoins. Read on:

The Research Paper

Bitcoin: A Peer-to-Peer Electronic Cash System

By Satoshi Nakamoto

satoshin@gmx.com

www.bitcoin.org

Abstract

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network.

The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power.

As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they’ll generate the longest chain and outpace attackers. The network itself requires minimal structure. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

1. Introduction

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes.

The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for non reversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party.

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers. In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions. The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes.

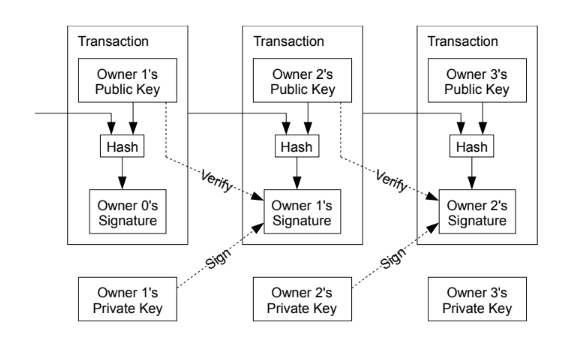

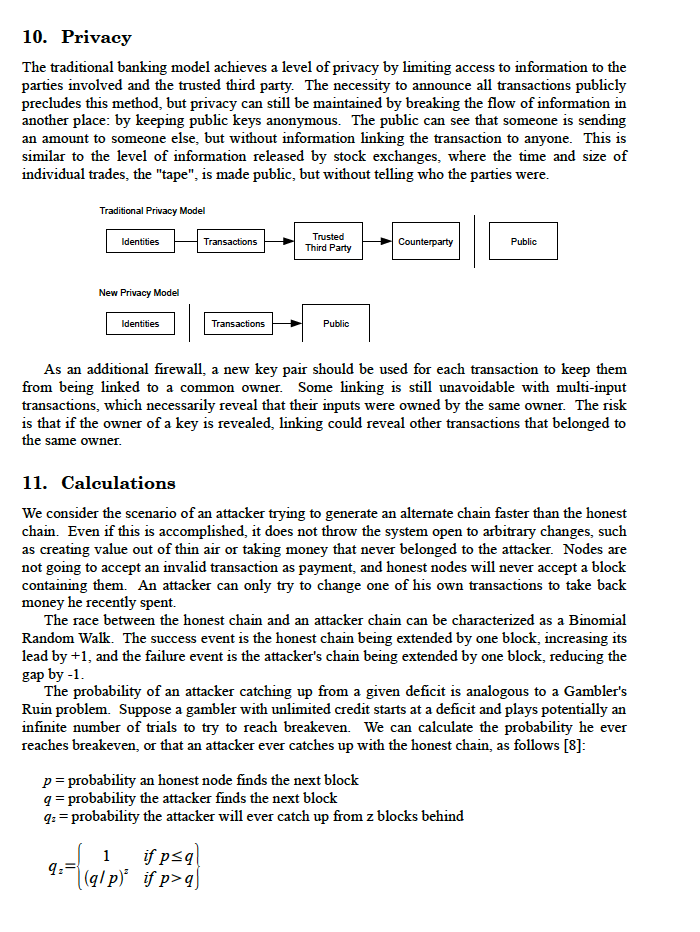

2. Transactions

We define an electronic coin as a chain of digital signatures. Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin. A payee can verify the signatures to verify the chain of ownership.

The problem of course is the payee can’t verify that one of the owners did not double-spend the coin. A common solution is to introduce a trusted central authority, or mint, that checks every transaction for double spending. After each transaction, the coin must be returned to the mint to issue a new coin, and only coins issued directly from the mint are trusted not to be double-spent. The problem with this solution is that the fate of the entire money system depends on the company running the mint, with every transaction having to go through them, just like a bank.

We need a way for the payee to know that the previous owners did not sign any earlier transactions. For our purposes, the earliest transaction is the one that counts, so we don’t care about later attempts to double-spend. The only way to confirm the absence of a transaction is to be aware of all transactions. In the mint based model, the mint was aware of all transactions and decided which arrived first. To accomplish this without a trusted party, transactions must be publicly announced [1], and we need a system for participants to agree on a single history of the order in which they were received. The payee needs proof that at the time of each transaction, the majority of nodes agreed it was the first received.

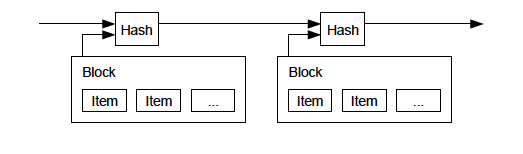

3. Timestamp Server

The solution we propose begins with a timestamp server. A timestamp server works by taking a hash of a block of items to be timestamped and widely publishing the hash, such as in a newspaper or Usenet post [2-5]. The timestamp proves that the data must have existed at the time, obviously, in order to get into the hash. Each timestamp includes the previous timestamp in its hash, forming a chain, with each additional timestamp reinforcing the ones before it.

4. Proof-of-Work

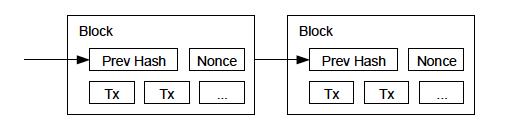

To implement a distributed timestamp server on a peer-to-peer basis, we will need to use a proof of-work system similar to Adam Back’s Hashcash [6], rather than newspaper or Usenet posts. The proof-of-work involves scanning for a value that when hashed, such as with SHA-256, the hash begins with a number of zero bits. The average work required is exponential in the number of zero bits required and can be verified by executing a single hash.

For our timestamp network, we implement the proof-of-work by incrementing a nonce in the block until a value is found that gives the block’s hash the required zero bits. Once the CPU effort has been expended to make it satisfy the proof-of-work, the block cannot be changed without redoing the work. As later blocks are chained after it, the work to change the block would include redoing all the blocks after it.

The proof-of-work also solves the problem of determining representation in majority decision making. If the majority were based on one-IP-address-one-vote, it could be subverted by anyone able to allocate many IPs. Proof-of-work is essentially one-CPU-one-vote. The majority decision is represented by the longest chain, which has the greatest proof-of-work effort invested in it. If a majority of CPU power is controlled by honest nodes, the honest chain will grow the fastest and outpace any competing chains. To modify a past block, an attacker would have to redo the proof-of-work of the block and all blocks after it and then catch up with and surpass the work of the honest nodes. We will show later that the probability of a slower attacker catching up diminishes exponentially as subsequent blocks are added.

To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If they’re generated too fast, the difficulty increases.

5. Network

The steps to run the network are as follows:

1) New transactions are broadcast to all nodes.

2) Each node collects new transactions into a block.

3) Each node works on finding a difficult proof-of-work for its block.

4) When a node finds a proof-of-work, it broadcasts the block to all nodes. 5) Nodes accept the block only if all transactions in it are valid and not already spent. 6) Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

Nodes always consider the longest chain to be the correct one and will keep working on extending it. If two nodes broadcast different versions of the next block simultaneously, some nodes may receive one or the other first. In that case, they work on the first one they received, but save the other branch in case it becomes longer. The tie will be broken when the next proof of-work is found and one branch becomes longer; the nodes that were working on the other branch will then switch to the longer one.

New transaction broadcasts do not necessarily need to reach all nodes. As long as they reach many nodes, they will get into a block before long. Block broadcasts are also tolerant of dropped messages. If a node does not receive a block, it will request it when it receives the next block and realizes it missed one.

6. Incentive

By convention, the first transaction in a block is a special transaction that starts a new coin owned by the creator of the block. This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue them. The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended.

The incentive can also be funded with transaction fees. If the output value of a transaction is less than its input value, the difference is a transaction fee that is added to the incentive value of the block containing the transaction. Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.

The incentive may help encourage nodes to stay honest. If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins. He ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.

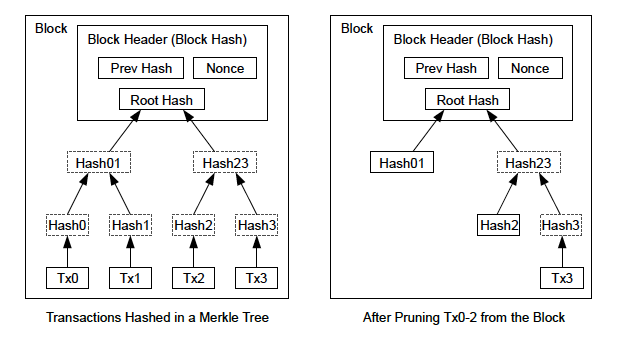

7. Reclaiming Disk Space

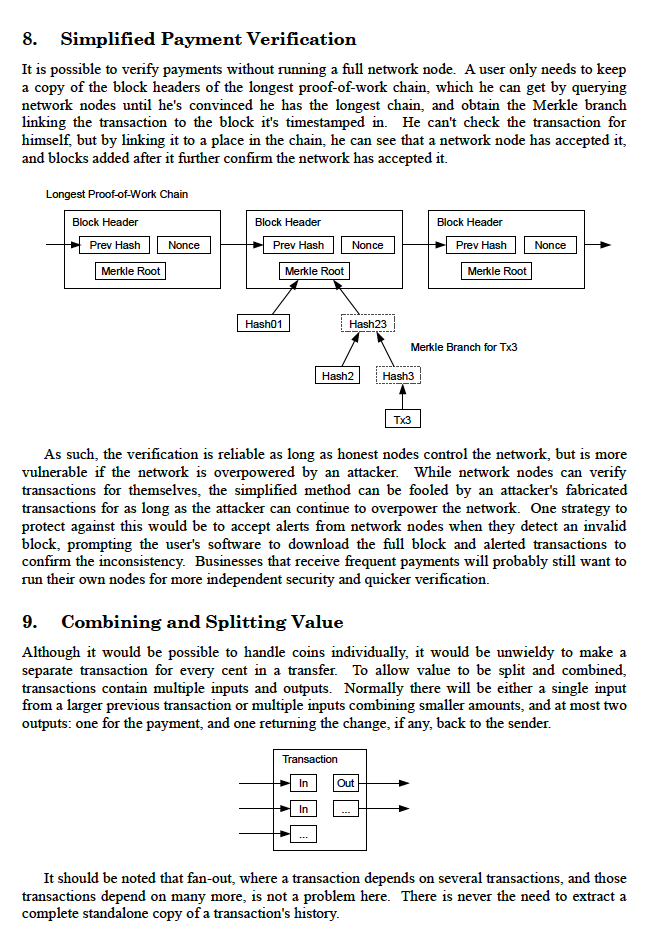

Once the latest transaction in a coin is buried under enough blocks, the spent transactions before it can be discarded to save disk space. To facilitate this without breaking the block’s hash, transactions are hashed in a Merkle Tree [7][2][5], with only the root included in the block’s hash. Old blocks can then be compacted by stubbing off branches of the tree. The interior hashes do not need to be stored.

A block header with no transactions would be about 80 bytes. If we suppose blocks are generated every 10 minutes, 80 bytes * 6 * 24 * 365 = 4.2MB per year. With computer systems typically selling with 2GB of RAM as of 2008, and Moore’s Law predicting current growth of 1.2GB per year, storage should not be a problem even if the block headers must be kept in memory.

While Satoshi Nakamoto’s research paper listed financial use of blockchain in a post 2008 world (after the collapse of Lehman brothers), his/her technique of identifying and validating transactions can be used in a variety of ways:

While Satoshi Nakamoto’s research paper listed financial use of blockchain in a post 2008 world (after the collapse of Lehman brothers), his/her technique of identifying and validating transactions can be used in a variety of ways:

Blockchain technology has the potential to revolutionize the way we live and work, by enabling the secure and transparent exchange of information and value.

Top potential uses of Satoshi Nakamoto’s Research Paper outside of Crypto in creation Of Decentralised Blockchain Networks:

- Banking Industry: One of the most well-known uses of blockchain is in the financial sector, where it can be used to facilitate secure and fast financial transactions. For example, cryptocurrency exchanges use blockchain to process and verify transactions, and many banks are exploring the use of blockchain to streamline their operations and reduce costs.

- Supply chain management: Blockchain can be used to track the movement of goods through the supply chain, from the manufacturer to the retailer. By providing a transparent and immutable record of each step in the process, blockchain can help to improve efficiency, reduce costs, and increase accountability.

- Identity verification: Blockchain can be used to create digital identities that are secure and portable, making it easier to verify a person’s identity online. This has the potential to revolutionize the way we access services and conduct business, by making it easier to verify a person’s identity in a secure and reliable way.

- Healthcare: Blockchain has the potential to transform healthcare by enabling the secure exchange of medical records and other sensitive information. This could improve the accuracy and efficiency of patient care, by making it easier for healthcare providers to access and share important information.

- Curtailing Voter Fraud: Blockchain could be used to create a secure and transparent voting system, by enabling the creation of a decentralized and immutable record of votes. This could help to increase confidence in the electoral process and reduce the risk of fraud or tampering.

- Real estate Deed Verification: Blockchain could be used to streamline the process of buying and selling real estate, by enabling the secure and transparent transfer of ownership. This could reduce the risk of fraud and errors, and make it easier to track the ownership and history of a property.

- Education Docs Verification: Blockchain could be used to create a secure and transparent system for storing and verifying educational qualifications and transcripts. This could make it easier for employers to verify an applicant’s credentials, and could also help to reduce the risk of fraud or counterfeiting.

- Intellectual property Validation: Blockchain could be used to create a secure and transparent system for managing and protecting intellectual property, such as patents, trademarks, and copyrights. By enabling the creation of a decentralized and immutable record of ownership, blockchain could help to reduce the risk of counterfeiting and other forms of intellectual property theft.

- Visa Stamping & Verification: Often people lie on their qualifications, or proofs of address, to get a visa, which can be curtailed if usage of blockhain becomes pervasive, and documents can be verified instantly and in real-time.

![[STARTUPS 101]: RMRK – A Remarkable NFT System For Smart Contracts](https://startupanz.com/wp-content/uploads/2021/05/blockchain-3277336_1280-218x150.png)