Working with early-stage companies is an exciting opportunity, whether it is reviewing potential investments as an angel investor or advising those in the community or investment portfolio. Recently, it seems the speed of development and the growth of Software-as-a-Service (SaaS) businesses resulted in an explosion of “product” companies over “platform” companies. In my estimation, the growth of “product” companies is a result of the amazing success of several “platform” companies who have opened their architecture to allow outside innovation due to their scale.

There are multiple ways to describe “product” companies and “platform” companies, so let me clarify how I see the two. First, a “product” company is one that sells a particular type of solution to a problem across a specific sector or type of industry. In contrast, “platform” companies seek to transform industries or sectors with a set of solutions and products. Products lack defensibility and often rely on other platforms for customer acquisition, data, or infrastructure. Conversely, platforms allow new products built at a significantly lower incremental cost and users pay for the new value offered versus just paying for consuming more of a service. The pricing page of a company will likely show you whether they have built a product or a platform as a product company will charge by the number of users while a platform will price according to the increasing value the products provide to the customer.

Further, there seems to be a push from some early-stage investors, advisors, and boards to focus on building product companies because the pipeline and customer acquisition model is more predictable. While this may create some risk mitigation, the focus results in limiting the upside potential of an investment. It also encourages capital allocation to be deployed towards product development and not platform growth. The result is a lack of focus on architecture and a desire to focus solely on selling specific products. There is an excellent discussion on “Pipe Thinking” and “Platform Thinking” at Platform Thinking Labs.

While “product” companies can be incredibly successful, I find most founders achieve product-market-fit early and seek to scale this solution. However, with the growth of software and the low cost to build new products, the need to identify founder-market-fit is increasingly needed to create new and sustainable companies. Founders should have a passion for transforming an industry, and while many previously worked in those sectors, others bring a view that delivering innovation in technology or business model will be transformative.

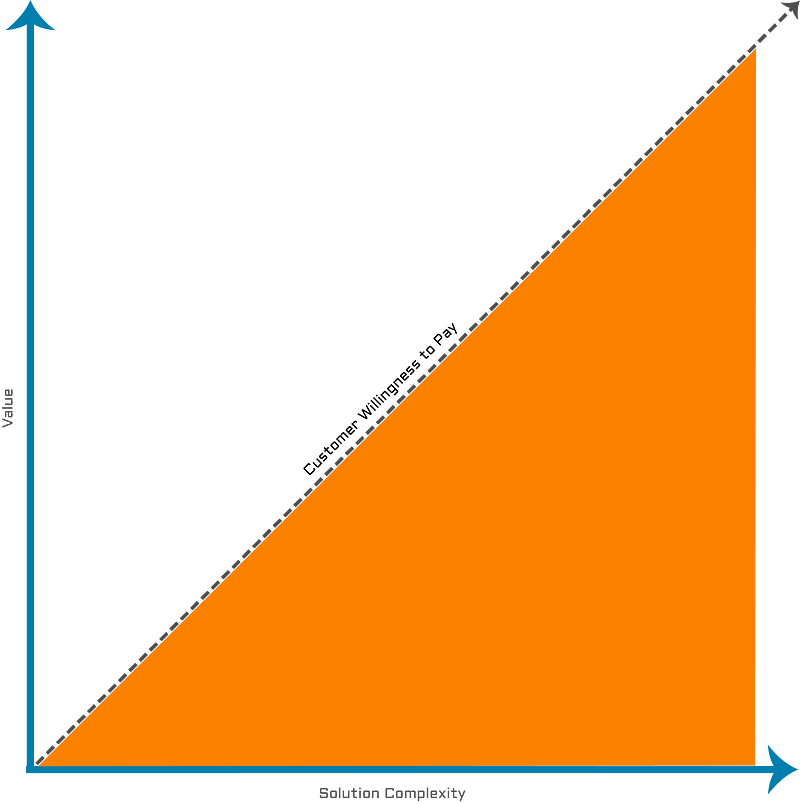

To better illustrate why companies should focus on building a platform strategy, I created several charts to explain the concept and underlying premise. First, and fundamental to my core assertion is that pricing directly correlates to the value received by the user. If you are familiar with value-based pricing, this is the core underlying belief. The graph below quite merely states that the more complex a problem that receives a solution, the more a customer is willing to pay.

In practical terms, this means that customers are willing to pay much less for storage per user than the price they would pay for having a full content and workflow management solution. If you are building a commodity service, then the market has to be substantially large enough that you can charge a minimal amount across millions of users. However, if you are building an industry-changing platform company, then you need to be able to provide solutions that address more complex problems by your customers.

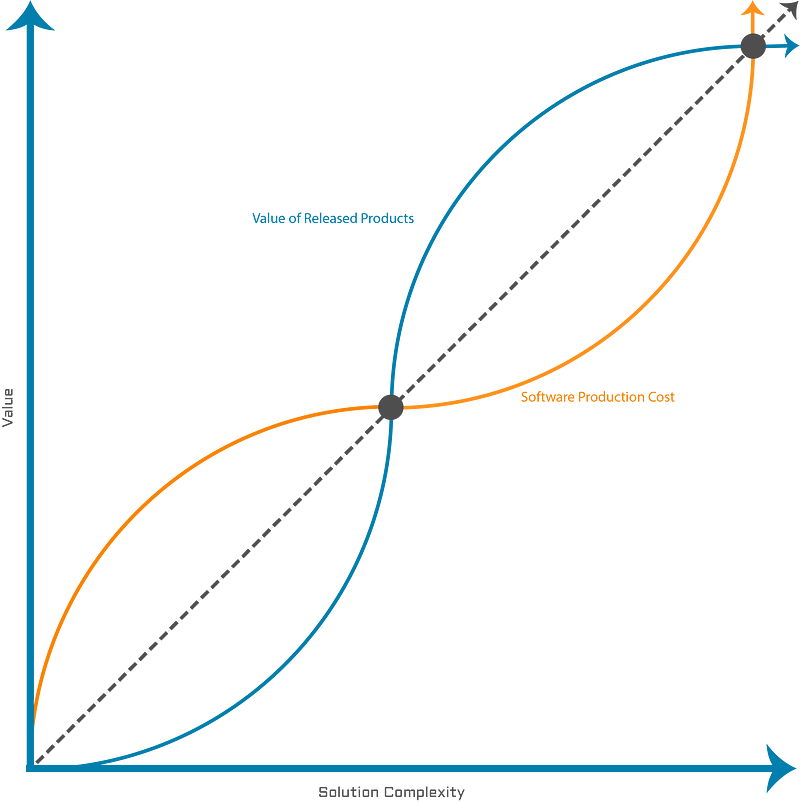

When building a platform company, you need a strong foundation of technology, processes, and people so you can increase the Average Revenue Per Customer. The below chart shows the relationship between the production costs associated with building a platform to solve challenges for customers. If it is a solution that addresses minimally complex problems, the cost is lower and the maximum value received is lower. For more complex challenges, the cost to build a new platform is more significant, and customers will pay more for the value they are receiving. While on the production side, each new feature added costs significantly less to build. If built with customer-focused releases, there should be minimally viable products that customers want though they do not wholly solve a problem. This value is often when a product brings technology to a business but does not address the core process or technology associated with solving the problem in an industry.

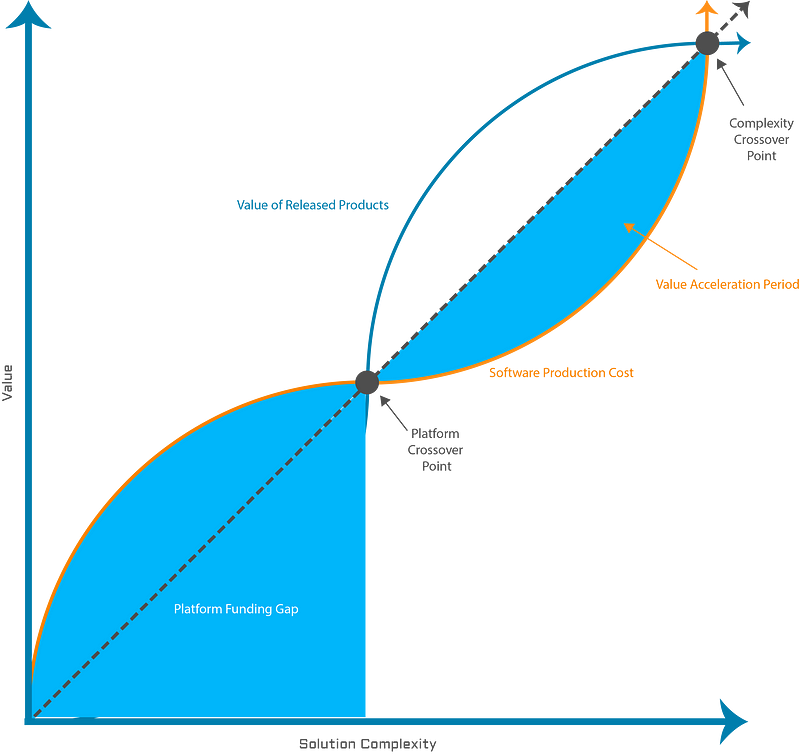

From an investor perspective, the Platform Funding Gap causes the core rift between founders and investors. The cost to build a platform is expensive, but there is the tremendous opportunity for Value Creation and Acceleration on top of the platform where the cost to build each new feature is less than the initial features.

Founders have solutions to minimize the Platform Funding Gap, but we as investors often discourage some of those methods. I want to make the following case why investors should look at alternative revenue sources in companies building a platform and reinforce the benefit of having founder-market fit.

First, the typical advice given to companies is they should be laser-focused on building their product and getting user growth and traction. Most metrics point to this, and often the founders also want to be focused on building products. If the founder has sufficient capital or a minimally viable set of products that when delivered at scale can fill the funding gap, then stay focused. However, if you are a startup not in Silicon Valley or want to remain focused on transforming an industry over fundraising, then perhaps the following will be more helpful.

Second, having strong Founder-Market-Fit provides a company with the knowledge and understanding to work with a small set of customers to solve their complex problems. The pricing and approach for this are not product-driven, it is much more customized and built with alongside the customer and gets grouped as professional services.

WHAT?!!! Did I just say professional services? consulting?!!! We don’t invest in lifestyle companies!!! We only invest in companies built to scale into massive markets with a product that everyone wants!!!

Let me be clear, I am not advocating building a professional services company, but I do believe professional services are a reliable revenue source that increases a company’s understanding of the market. Further, professional services companies can be viable companies and we should not be afraid of building sustainable businesses as entrepreneurs and founders while also looking over the horizon to the future. While Paul Graham talks about doing things that do not scale, I disagree that companies should not use it as a source of revenue. Companies should never be afraid to require customers to pay for services where they receive value. An ancillary benefit for the founders who came from the industry the company focuses is their passion often comes from working on significant problems and challenges for the industry. They are thought leaders and seek to be transformative, and the relationships they build will drive the marquee customers that provide referential value for the company.

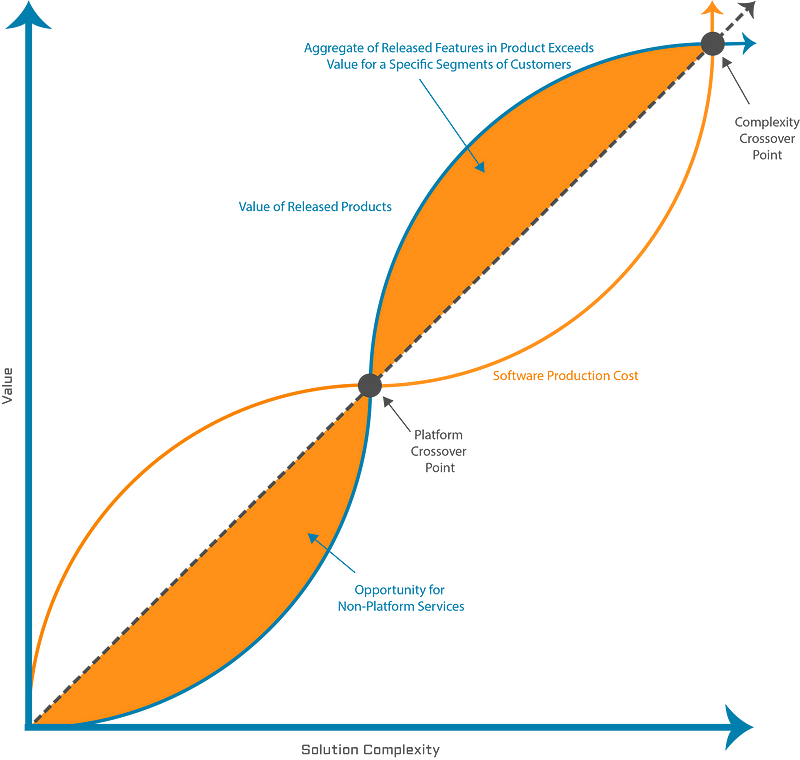

The graph above highlights where there is the opportunity to build non-platform services that will most likely be people getting paid for providing one-time services, i.e., professional services. Early in the lifecycle of a company, the services may each be customized, but as the company progresses, the company may choose to use services to fill in the gaps where the platform has yet to be entirely built, e.g., installation and integration services.

At some point, the company will get to what I call the Platform Crossover Point. This point is where the professional services should be phased out of the company and the focus should move from the exploration of the business model and focus exclusively on adding users to the platform. During this phase, the most value is created, and new features and products developed at such speed that new customer segments begin to emerge on the platform. Often this results in new features being added to the platform that many users do not use, but sufficiently large customer segments.

The next major inflection point is the Complexity Crossover Point. This point is where adding new features or solving new problems gets to the point of irreducible complexity or perhaps more clinically where the cost of development on the platform exceeds the value a customer is willing to pay. These complex areas become interesting when thinking about new products, platforms, and services to be offered by companies and the ecosystem of partners a platform develops. They are also areas where new technologies may change or be enhanced by the platform a company created.

My goal with this article is to give founders and investors a new lens to think about how to build companies that can be more sustainable and also built with greater capital efficiency. Companies that focus on delivering increasing value to customers will have the culture to sustain and innovate for the long term. They will be companies that will never let a platform languish, and the employees will have a cult-like focus on using the platform to transform an industry because no one builds a cult-like following just trying to sell a product.