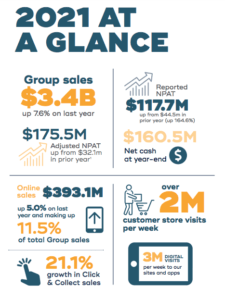

AUCKLAND: New Zealand’s largest retailer the $3.4 billion Warehouse Group Limited (“the Group”) has provided a trading update for the five months ending January 2nd, 2022.

On November 12th, 2021, the Group reported that sales for the first quarter of FY22 were 14.6% below sales for the same period in FY21, with only 2 weeks of the quarter not impacted by the COVID-19 lockdown levels.

Early in the second quarter of FY22 Auckland moved to Level 3 Step 2, which allowed the Group’s Auckland stores to reopen from 10 November and removed a significant trading constraint.

For the first two months of the second quarter, Group sales were up 2.3% on FY21 and 8.6% on FY20 sales for the same period.

This brought total Group sales for the five months ending January 2nd, to $1,465.9 million, a decrease of 5.7% or $88.8m compared to the same period in FY21, which is an improvement on the position reported in the Q1 sales update, when sales were down 14.6% or $107.7m.

Gross profit margin for the first five months of FY22 was 55bps lower than the same period in FY21 but up 132bps versus FY20.

A contributing factor to the reduction was the sudden increase in online sales which for this period increased 105% on the same period in FY21, to comprise 18% of sales.

This has reduced gross profit margin through a lower margin product mix and higher freight costs associated with online sales, exacerbated by capacity constraints throughout New Zealand’s delivery network.

Click and collect accounted for 50% of the online sales, which is an 89% increase on the same period in FY21.

The ongoing disruption to worldwide supply chains has made managing stock flow through the peak trading period challenging.

The Group’s robust shipping and stock management controls have managed inventory levels while ensuring availability of key continuity and seasonal lines for customers.

The Group is well positioned for the remainder of summer and Back to School trading periods.

Based on actual sales for the first five months of FY22 the Group expects Adjusted Net Profit After Tax (NPAT) for HY22 to exceed $40m.

This compares to $111m in HY21 and $46.2m in HY20. The second quarter is expected to continue to trade at or slightly above the same quarter last year and this would result in sales for the half-year being circa $80m less than FY21. Other major impacts on HY22 NPAT versus HY21 include cost of business and GPM.

Cost of doing business is expected to be $35 million higher in the half-year, reflecting higher store labour costs, increased investment in TheMarket and an increase in digital spend.

It is also expected that there will be additional costs of $10m – $12m reflecting the COVID-related impact to operations

The Gross Profit Margin in the first half of FY21 benefited from a $10m decrease in inventory provisioning from FY20 and reduced discounting.