By Harsimran Julka

In one of the biggest technology sector deals in the past three years, Twitter, Inc. (NYSE: TWTR) today announced that it has entered into a definitive agreement to be acquired by an entity wholly owned by Elon Musk, for $54.20 per share in cash in a transaction valued at approximately $44 billion. Upon completion of the transaction, Twitter will become a privately held company.

Under the terms of the agreement, Twitter stockholders will receive $54.20 in cash for each share of Twitter common stock that they own upon closing of the proposed transaction.

How The Deal Can Change The Social Media Landscape

The news of sale has left the world’s social media users distraught, some posting memes of whether to go back to the era of Google+, if Musk tries to muzzle free speech. Twitter was known to have a left leaning bias, as remarked by its founder Jack Dorsey openly. However, it tried to carry all sides of a story and opinion, unless the tweet advocated violence of any kind.

However with Musk’s ownership of Twitter, the company is likely to go private, and delist from stock exchanges, making its workings less transparent. On the flip side, the company is likely to become more profitable, by charging users for basic features such as verification.

The world’s richest man, Elon Musk has been an active Twitter user, posting random Tweets even at night. An ex-founder of Paypal, Musk owns Tesla, Spacex, Hyperloop and other companies actively trying to change the transportation whether on earth or to outer space.

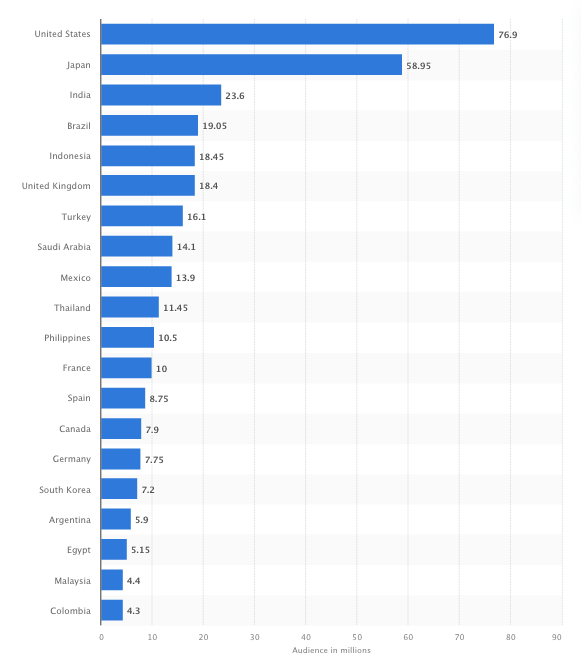

Twitter Users By Country

However most of Musk’s wealth is tied to his holdings in Tesla and SpaceX, which are now worth $1 trillion and $74 billion respectively. Musk holds about 17% in Tesla, making his wealth skyrocket to a whopping $261 billion.

With the acquisition of the world’s third largest social media platform, Musk will have a lot of control over information that could impact the rise or fall of governments, across the world. Whether Musk chooses to exercise that control in a free and fair manner. Only time will tell.

I hope that even my worst critics remain on Twitter, because that is what free speech means

— Elon Musk (@elonmusk) April 25, 2022

For world’s social media users, however there is now little choice left, as Facebook openly sides with governments to control free speech. The acquisiton however will also open an opportunity for investments into newer startups that can actively try to take the place of Twitter, in the rising social sharing economy.

The acquisition also puts Musk in the league of Amazon founder Jeff Bezos, who owns Washington Post, one of the largest newspapers in the United States.

The Cash Deal Is The Biggest In Internet Space

The purchase price represents a 38% premium to Twitter’s closing stock price on April 1, 2022, which was the last trading day before Mr. Musk disclosed his approximately 9% stake in Twitter.

The deal makes it to the world’s largest ever in the internet world in terms of cash paid for an acquisition.

Acquisition prices:

Twitter: $44 billion (Elon Musk)

Slack: $28 billion (Salesforce)

LinkedIn: $26 billion (Microsoft)

WhatsApp: $19 billion (Facebook)

Skype: $8.5 billion (Microsoft)

YouTube: $1.65 billion (Google)

Tumblr: $1.1 billion (Yahoo)

Instagram: $1 billion (Facebook)— Jon Erlichman (@JonErlichman) April 25, 2022

Bret Taylor, Twitter’s Independent Board Chair, said, “The Twitter Board conducted a thoughtful and comprehensive process to assess Elon’s proposal with a deliberate focus on value, certainty, and financing. The proposed transaction will deliver a substantial cash premium, and we believe it is the best path forward for Twitter’s stockholders.”

Parag Agrawal, Twitter’s CEO, said, “Twitter has a purpose and relevance that impacts the entire world. Deeply proud of our teams and inspired by the work that has never been more important.”

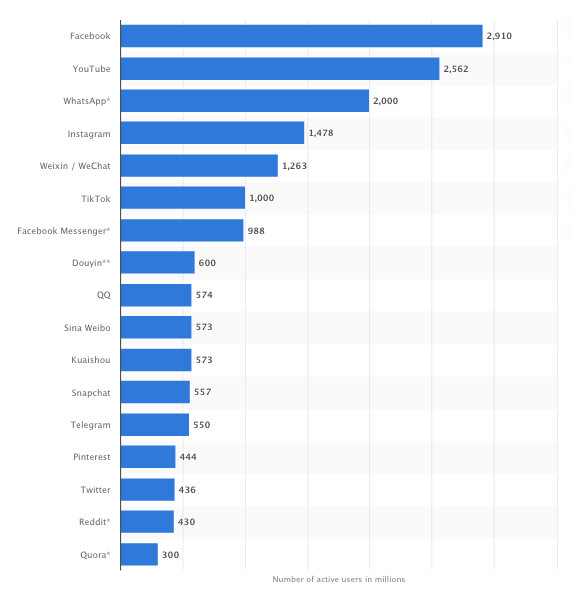

Social Media Platforms By Active Users

“Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated,” said Mr. Musk.

“I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans.“

What’s In It For My Brand’s Social Strategy:

Diversify your social media strategy if your client or brand is heavily focused on Twitter for marketing or online customer care. The platform may find some suitors and baitors in each market as the government of the day reacts to the platform.

It will also depend upon how much leverage that country’s government will have upon Elon Musk’s other businesses including Tesla. Thus it will be safe to diversify your brand’s social media strategy and have a cross platform approach to build your strategy.

CONCLUSION:

With big tech altering election results and with no control over ad sources, it’s highly likely that regulations may come to put social media platforms in line in the United States. Brexit and Trump election were two major events where big tech platforms played a key role in altering public opinion, even as the platforms struggled to control fake news.

Former US President Barak Obama, this month advocated need for self regulation of big tech platforms, that can alter societies in future, it’s highly likely that the Biden administration may step in with some guidelines, in coming months.

.@PressSec on @elonmusk purchasing @twitter: "The president has long been concerned about the power of large social media platforms, the power they have over our everyday lives, has long argued that tech platforms must be held accountable for the harms they cause." pic.twitter.com/uWRizqqET4

— CSPAN (@cspan) April 25, 2022

While Twitter is certainly not the largest social media platforms, but it is definitely the most powerful media platform, with almost all Prime Ministers and Presidents, and world’s opinion makers, present on it.

This deal, gives the control of the world’s microphone into one person’s hand. With a few algorithmic changes, the reach of a certain Twitter handle can suddenly be muzzled in one geography or another.

Disinformation is a threat to our democracy, and will continue to be unless we work together to address it. Tune in as I share some thoughts on what we can all do now. https://t.co/6R6n3MOPPR

— Barack Obama (@BarackObama) April 21, 2022

Whether Musk choses to directly exert his control over world’s politics by using this power, or use his ingenuity to control fake news, it will be interesting to see. Nevertheless, Musk’s Twitter deal might impact his other businesses especially Tesla, which require siginificant government interventions in tariff control or regulations across export markets.

With the Twitter buyout, Musk has also taken a siginficant risk on his other most valuable businesses SpaceX (which has to work with NASA) and administrations around the world. The prudent way out will be to sell his majority stakeholdings to institutional buyers, after taking Twitter private.

(The author is a writer on technology and startups)

![[STARTUPS 101]: Tisane: Using AI To Block Abusive Trolls On Social Media](https://startupanz.com/wp-content/uploads/2021/03/artificial-intelligence-3382507_1280-218x150.jpg)