AUCKLAND | MELBOURNE: Global outdoor, lifestyle and sports company, KMD Brands Limited (ASX / NZX: KMD has announced its results for the six months ended 31 January 2022 (1H FY22).

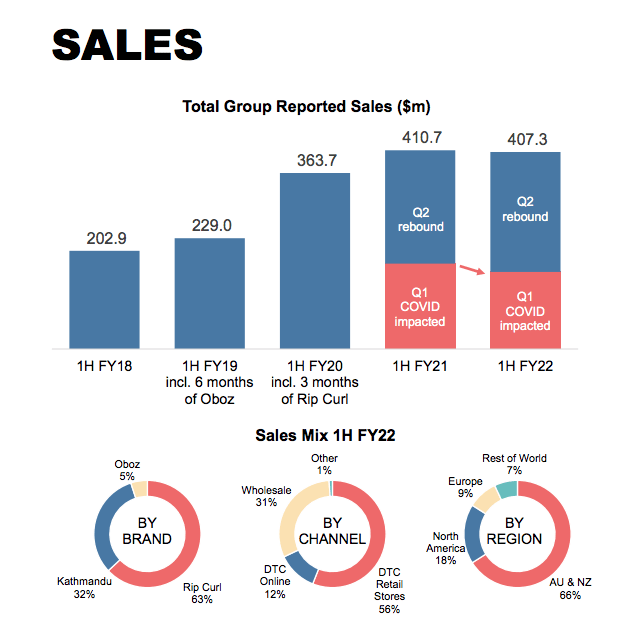

The company recorded sales of NZ$407.3 million about $3 million less than that recorded in the first half of FY21, following Q1 COVID lockdown that impacted sales of Kathmandu and Rip Curl in Australasia.

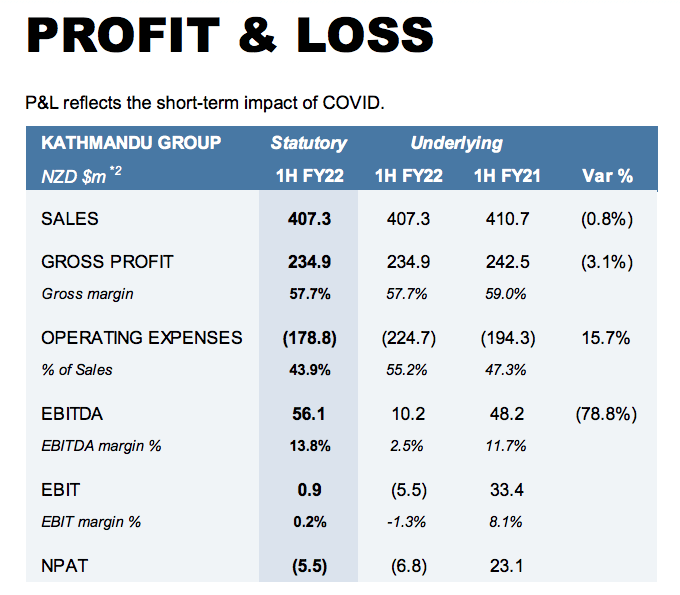

The company recorded a gross margin of 57.7% (1H FY21: 59.0%), due to elevate international freight costs and increased clearance mix for the Kathmandu brand.

The company recorded sales of NZ$407.3 million about $3 million less than that recorded in the first half of FY21, following Q1 COVID lockdown that impacted sales of Kathmandu and Rip Curl in Australasia.

The company’s subsidiary Oboz was impacted by temporary closure of Vietnam factories during pandemic lockdowns.

The company recorded a gross margin of 57.7% (1H FY21: 59.0%), due to elevate international freight costs and increased clearance mix for the Kathmandu brand.

EBITDA was also down $10.2 million (1H FY21: $48.2 million) with a Net loss of $5.5 million due to pandemic closures. Despite the pandemic, KMD interim dividend increased by 50% to 3.0 cents per share.

“We opened twelve new owned / licensed retail stores globally, and online sales increased to 17.4% of direct-to-consumer sales, rewarding initiatives to elevate digital capabilities. Substantial progress was also achieved on our ESG strategy.” Group CEO & Managing Director Michael Daly said:

“The Kathmandu Australasian store network was more impacted by COVID closures in Q1 than the Rip Curl global store network, before recovering strongly in Q2,” Daly said.

Rip Curl’s results were supported by strong sales growth in online and wholesale channels, with total sales up 2.7% on 1H FY21. Europe and Hawaii in particular achieved strong sales growth, while North America was impacted by wetsuit shortages and port congestion, and Australia was impacted by COVID-related store closures during Q1.

Direct-to-consumer (‘DTC’) same store sales growth (comprising owned retail stores and online) was up 2.1%, adjusted for COVID lockdowns. Wholesale sales were up 16.1%, with less COVID interruption to the 1H FY22 sell-in period than last year. The slight reduction in gross margin to 59.2% (1H FY21: 59.9%) was due to a higher wholesale mix and elevated international freight costs.

“While we continue to navigate impacts from COVID on global supply chains, forward demand for our Rip Curl and Oboz products remains at record levels, and Kathmandu enters the traditionally strong winter season well prepared.”

“We remain focused on several key initiatives to elevate our digital capabilities, with the Club Rip Curl loyalty scheme due to launch in the second half,” Daly said.