Private Equity firms invested a record $8.2 billion (across 158 deals) in India during the quarter ended June 2018 – up 60% compared to the $5.1 Billion (across 153 transactions) in the same period last year, according to data from Venture Intelligence (http://www.

The investment amount in Q2’18 was as much as 112% higher than the immediate previous quarter (which had recorded $3.9 Billion being invested across 157 transactions).

The latest quarter witnessed 24 PE investments worth $100 million (accounting for almost 83% of the total investment value during the period) compared to just 10 such transactions in Q2’17, the Venture Intelligence data showed.

Of these, 12 were larger than $200 million each (by themselves accounting for 64% of the total value) – compared to seven such investments in the year ago period.

The latest figures takes the total PE investments in the first half of 2018 to $12.4 Billion (across 315 deals) – a figure similar to that recorded in first half of 2017 (across 358 transactions). The calendar year 2017 was the biggest ever year for PE investments in India, recording $23.5 Billion across 660 deals.

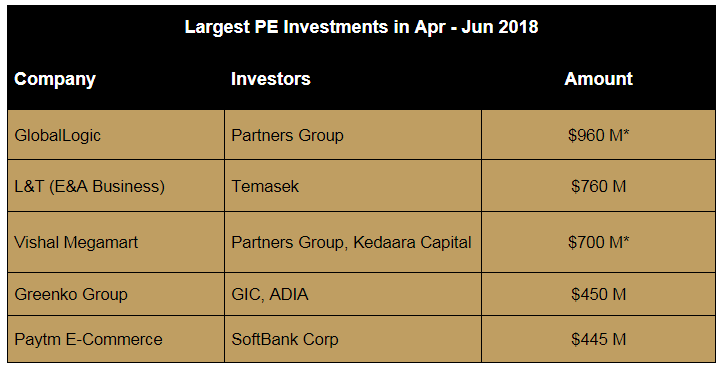

The biggest PE investments reported during Q2’18 included the investment by Partners Group in outsourced IT product development firm GlobalLogic (via a secondary purchase from Apax Partners) for about $960 million, followed by Temasek’s contribution of about $760 million to the buyout of the L&T Electrical & Automation business by Schneider Electric.

By Industry

IT & ITeS companies accounted for 31% of the PE investment pie ($2.6 Billion across 83 deals), led by the GlobalLogic deal and included Temasek’s $250 million investment in another mature IT Services firm, UST Global. Internet & Mobile companies – Paytm E-Commerce ($450 million); PolicyBazaar ($236 million) and Swiggy ($210 million) – completed the list of Top 5 PE investments in Tech during Q2’18.

Manufacturing companies, led by the L&T E&A Business, attracted 16% of the pie ($1.3 Billion across seven deals). Healthcare & Life Sciences companies (led by ChrysCapital’s $350 million investment in Mankind Pharma) accounted for 12% and Energy companies (led by the Greenko Group investment) for 10%.

The share of BFSI companies slipped to less than 10% of the pie during Q2’18, despite attracting four investments of over $100 million – in IARC; AU Small Finance Bank; IndiaFirst Life Insurance and India Infoline Wealth.

“Not even five years ago, in 2013, $8 Billion was the figure for PE capital that got invested during the entire year. Exceeding that in just one quarter, shows the extent of the confidence bounce back among investors for the Indian PE asset class, as well as in the macro environment,” pointed out Arun Natarajan, CEO of Venture Intelligence.

“The recent strong exits from Flipkart and other companies, as well as the fact that the investments in Q2’18 have been spread across many sectors, lends confidence to the sustainability of the uptrend,” he added.