SHANGHAI: As the global supply chain prepared to recover from the collateral damage caused by COVID in 2022, China lockdowns hit the industry back at a time when the companies prepared to kick off the produce shipping season (April-July). Disruptions, one after the other, are taking the capacity away from the market.

As a result of the Zero COVID strategy in China, many factories reopen while others further go into shut down.

Historically, this time of the year is crucial for most companies as they begin to ship fresh production in preparation of the early peak season.

Lockdowns in China will not just be a production slowdown, but also a slowdown of cargo movement, both being detrimental to the supply chain. While the ports in the United States will not feel the pinch before 3-5 weeks until the backlog improves.

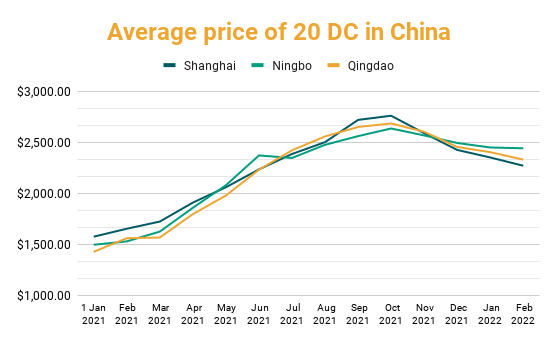

In the past one month, from February to March, average container prices have declined from 12-18% at ports of Shenzhen, Qingdao and Ningbo amongst others. Going by how the average prices developed last year after the Ningbo port shut down (July –August 2021), we expect the prices to increase in the long run. Zooming in, these average prices are expected to decline for a few days or weeks as these ports in China experience restricted exports, while still importing.

Once the Chinese ports fully resume operations, there will be pressure to deliver more containers which will lead to rise in average container prices in the next few months as the industry inches closer to the pre-peak season. What remains to be seen is whether the prices reach the old highs.

However, with the announcement of nationwide lockdowns, the supply chain must prepare for another turmoil in the coming months, impeding the flow of container movement as importers worldwide prepare for the coming peak season later this year.

So far the impact is curtailed as demand has slowed. The platform data of Container xChange shows that the average prices of 40 ft high cube cargo worthy containers at the port of Shenzhen dropped by 12.4% from $5887 on 27th February to $5154 on 20th March 2022. For a 20 ft cargo worthy DC at Shenzhen, these prices fell by 18.8% from $2800 on 15 February to $2272 on 20 March.

At the port of Ningbo, the average prices for 40 ft cargo worthy HC containers dropped by 15.8% from $5930 on 14 February to $4990 on 20th March 2022 and for 20 ft cargo worthy DC the prices dropped by 13.5% from $2603 on 14th February to $2251 on 20th March 2022.

At the port of Qingdao, the average prices for 40 ft cargo worthy HC containers dropped by 12% from $5420 on 26 February to $4748 on 20 March 2022 and for 20 ft cargo worthy DC the prices dropped by 12.5% from $2360 on 26 February to $2064 on 20 March 2022.

However, the lockdowns in Shenzhen, Zhejiang, Shanghai, Jilin, Suzhou, Guangzhou and Beijing (19 provinces as of Sunday, probably more to come in a few days) imposed now will clearly heavily restrict container movement at these ports which will, as we’ve seen in the past, prove to be further damaging for the global supply chain.

Clearly, 2022 has not brought any cheer to the supply chain industry. On top of this, war will just prove to be another disruption amongst the other innumerable factors for China’s supply chain.

Freight rates and container prices were already at a record high even before the invasion started and what happened immediately due to the war is that the Russian ports were not being called by the national shipping lines anymore, the black sea being somehow closed, and the Asia European railway being quite hit by this

“The immediate impact of this on the overall supply chain has not started to show up. Not ignoring the fact that the Russian importance on global trade is not big enough for the containerised cargo to really disrupt the supply chains. We see on the other side, the container prices at record highs, containers piling up and a massive shortage as well. This is a result of many more other disruptions over the past two years since the pandemic started,” said Dr Johannes Schlingmeier, co-founder and CEO, Container xChange.

“Lockdowns in China will further reduce capacity and cause a surge in already inflated shipping prices. The shockwaves will be felt across the US and America, and almost everywhere in the world.” added Dr Schlingmeier.

In the immediate future, the closure of the Asia-European railway (which only accounts for roughly 2.5% of Asia-Europe cargo) will cause the high-value cargo to be pushed to ocean freight which is already low in capacity.

This will put more pressure on the already struggling supply chain. Adding on top of this, China’s lockdowns will be nothing less than a major shockwave to an already crippled supply chain.

If industry reports are to be believed, China could emerge as a buyer for Russian crude which could help alleviate some of the current global supply concerns as the EU could in turn buy more from the Middle East. With the COVID outbreaks and subsequent lockdowns, this expected surge in trade will slow down at least for some weeks/months.

Furthermore, there are midterm and long-term implications that analysts foresee, such as disruption in the trade of goods and increased U.S. efforts to insulate itself from geopolitical shocks to international supply chains fuelled by key sectors of the Chinese economy.

Currently, China controls most of the global market for the processing and refining of rare earths and critical minerals.

Inbound containers in China rise, expected to further increase due to lockdowns

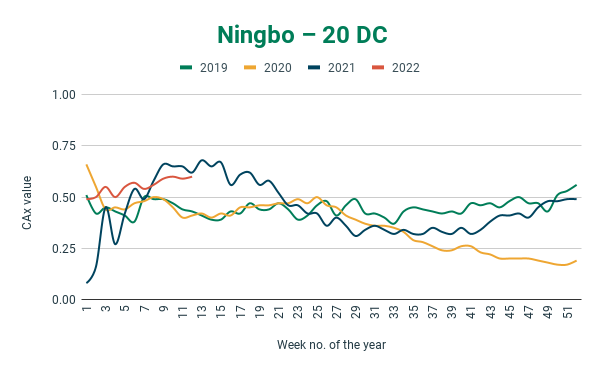

The CAx (Container availability index) for two of China’s major ports (Shanghai and Ningbo) is expected to increase further at a rather fast pace from around the 0.6 mark in the second week of March, meaning more inbound containers than outbound. It is unusual for this Asian behemoth that normally exports more than it imports – exhibiting the persisting bottlenecks of its trade routes and the bottlenecks that will inevitably emerge from these lockdowns.

![[Post Pandemic]: How Australia’s Univs Can Recover From Travel Ban](https://startupanz.com/wp-content/uploads/2020/12/nep-2020-what-does-the-new-policy-mean-for-learners-and-indias-education-system-218x150.jpg)